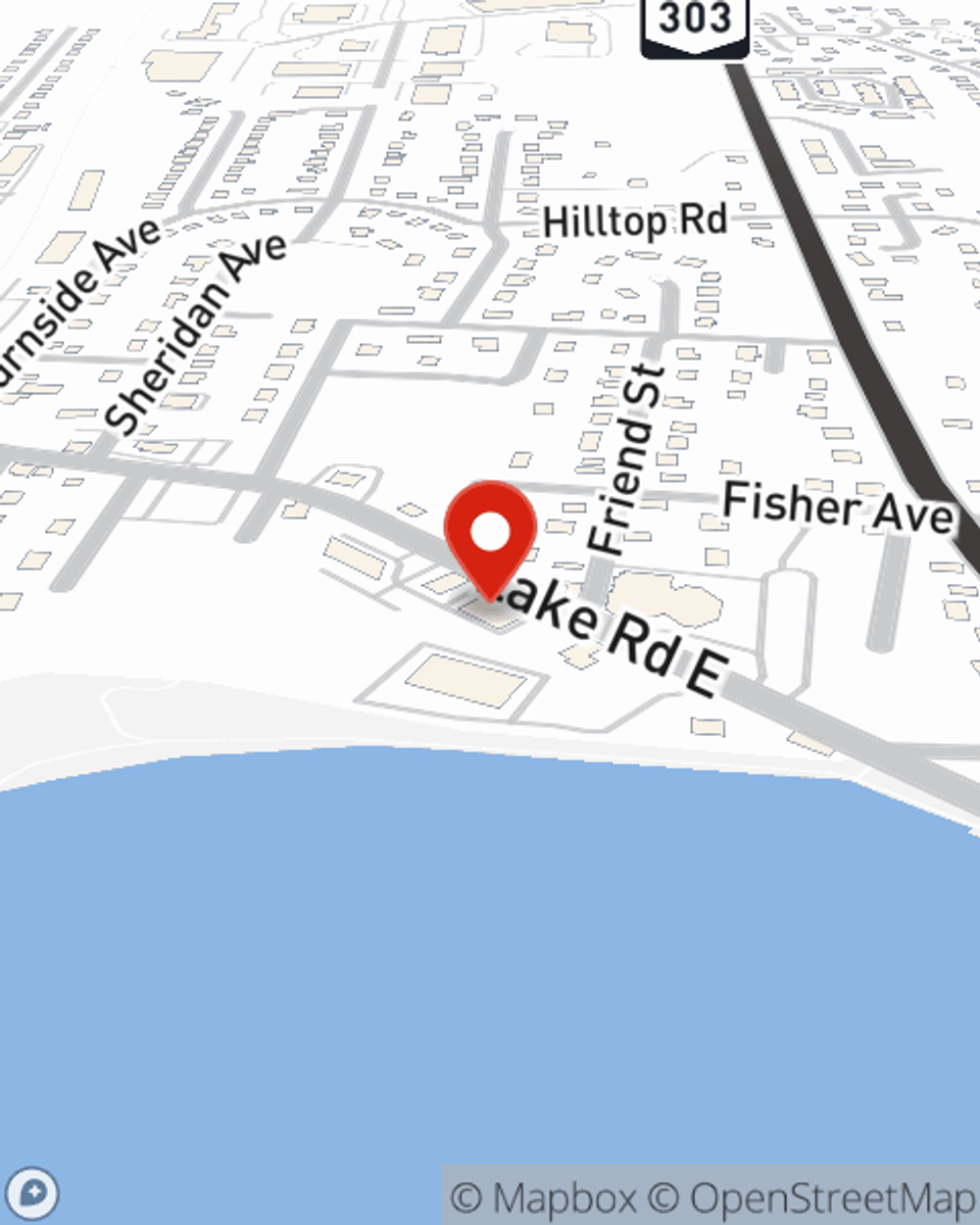

Condo Insurance in and around Congers

Here's why you need condo unitowners insurance

Insure your condo with State Farm today

- Congers

- Nyack

- Valley Cottage

- New City

- Haverstraw

- West Nyack

- Nanuet

- Pomona

- Thiells

- Stony Point

- Blauvelt

- Pearl River

- Orangeburg

- Tappan

- Bergen County, NJ

- Spring Valley

- Tallman

- Suffern

Home Is Where Your Heart Is

As with any home, it's a good plan to make sure you have coverage for your condominium. State Farm's Condo Unitowners Insurance has outstanding coverage options to fit your needs.

Here's why you need condo unitowners insurance

Insure your condo with State Farm today

State Farm Can Insure Your Condominium, Too

With this coverage from State Farm, you don't have to be afraid of the unanticipated happening to your unit and personal property inside. Agent Debbie McGuinness can help provide all the various options for you to consider, and will assist you in building a fantastic policy that's right for you.

Getting started on an insurance policy for your condominium is just a quote away. Get in touch with State Farm agent Debbie McGuinness's office to check out your options.

Have More Questions About Condo Unitowners Insurance?

Call Debbie at (845) 267-2900 or visit our FAQ page.

Simple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

Debbie McGuinness

State Farm® Insurance AgentSimple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.